The Global Standard for Regulatory Banking Certification

Our proven framework for making regulatory reports, models, and data assets trusted, auditable, and regulator-ready.

Regulatory and compliance data demands more than governance and documentation, it demands formal certification. Our Regulatory Certification Framework™ (RCF) enables institutions to certify adherence to regulatory expectations across their most critical assets - data, reports and model risk obligations and controls.

Whether you're preparing for BCBS 239, OCC Risk Data Aggregation and Reporting Heightened Standards, BSA/AML compliance, or internal audit readiness, RCF delivers a repeatable, defensible, and certifiable model of compliance assurance.

__PRESENT__PRESENT__PRESENT__PRESENT__PRESENT

✅ What Is Regulatory Certification?

The RCF Certification is a structured process that culminates in a formal, evidence-based certification of control effectiveness and regulatory alignment.

It helps your institution: 👇

Certify Critical Data Assets

With OCC Heightened Standards, RDAR (BCBS 239), CECL, Basel, and more

Governance & Audit-Ready

For internal audit, regulators, and executive committees

Control Ownership

Wh alignment and operating effectiveness across the 3 lines of defense

Defensible Certification

That stand up to regulatory scrutiny and instills high-trust

🏛️ Designed for Regulated Institutions

⚖️ U.S. Banks subject to OCC Heightened Standards, RDAR, and other regulatory mandates

📊 Chief Risk Officers & Chief Data Officers responsible for demonstrating program maturity

📝 Internal Audit and Compliance Teams that require verifiable evidence and repeatable testing

🎯 Boards & Executives seeking visibility and assurance across regulatory domains

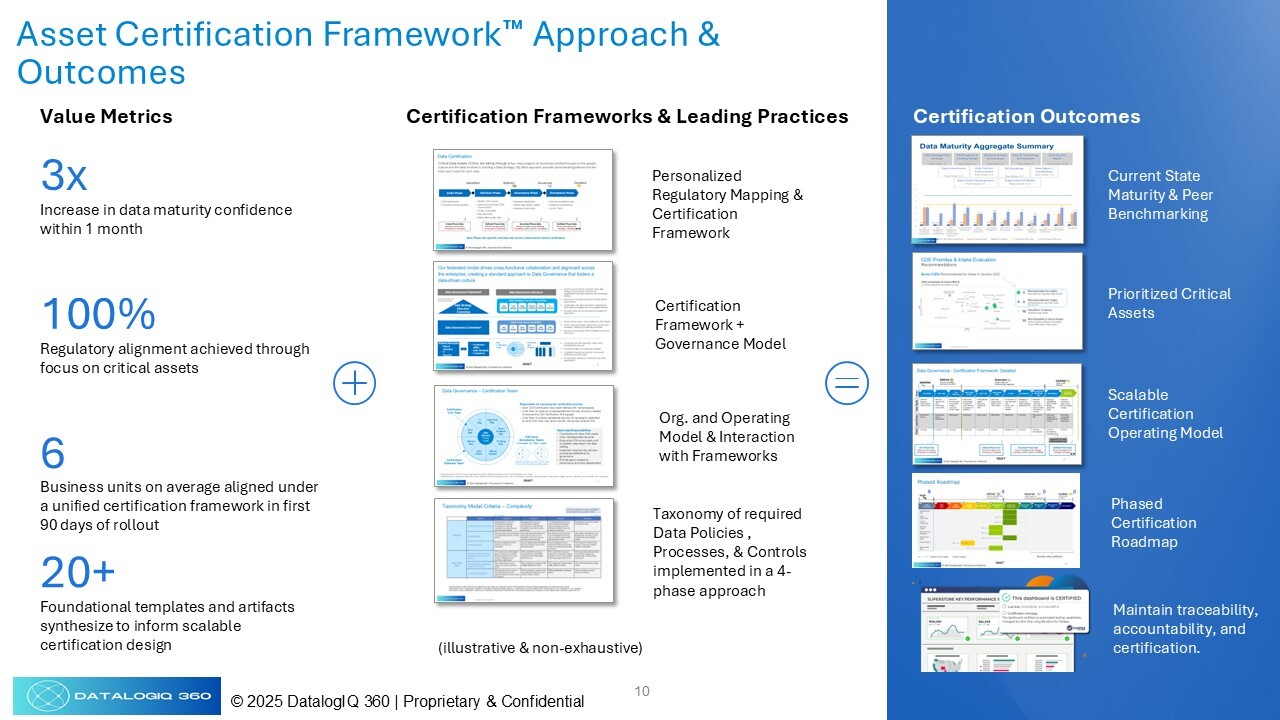

Our certification process follows a four-phase certification lifecycle:

Scoping & Applicability Mapping

Define regulatory domains, identify applicable standards, and align with enterprise risk taxonomy

Inventory and Evidence Aggregation

Inventory critical data assets, collect artifacts, controls, policies, and data quality measures tied to accountable owners

Control Effectiveness Review

Facilitate first-line self-assessment and second-line independent challenge of control operation

Certification & Reporting

Issue a formal certification statement, including heatmaps, exceptions, compensating controls, and status metrics

🤝 Why Datalogiq360?

We’ve helped $100B+ banks:

-

Successfully certify compliance with OCC Heightened Standards

-

Prepare audit-ready packages for internal audit and regulators

-

Establish traceable certification workflows with line-of-defense accountability

Our combination of regulatory experience and data governance expertise ensures your certification is both credible and defensible.

Ready to Move Beyond Spreadsheet?

Leverage our CoComply platform that automates the certification process, helping you manage governance across your entire organization, no matter how distributed.

Inventory & Certification FAQs

What are the benefits of having an critical data asset inventory?

Inventorying doesn’t have to be painful. We identify what's critical and speed up the process by pre-populating based on regulatory agencies & requirements, common use cases, and risk levels.

Do I need to inventory my all critical assets?

It is highly recommended, especially within medium to large organizations but we usually start with 1 asset type and even apply our tiering methodology to further prioritize and accelerate the process.

Lacking visibility into Tier 1, high risk assets exposes companies to legal, financial, reputational, and operational risks.

Why do organizations need to certify their assets?

To build and maintain trust with their customers, internal staff and regulatory obligations.

Certifications also ensure organizations know where to prioritize their efforts, beginning with high risk assets and use cases.

How do you conduct certifications and risk assessments?

ACF’s comprehensive framework assesses critical assets against a backdrop of active regulatory requirements and legislation, considering the data assets quality and use case to pinpoint compliance and risk management needs.